GETTING A HOME LOAN SHOULDN’T BE HARD

SEE HOW SIMPLE IT IS

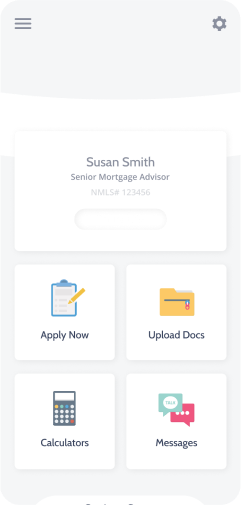

The Loanzify App guides you through your mortgage financing and connects you directly to your loan officer and realtor.

MORTGAGE PAYMENT CALCULATOR Calculate how much your monthly mortgage payment could be.

* Results are hypothetical and may not be accurate. This is not a commitment to lend nor a preapproval. Consult a financial professional for full details.

Home Loans in California

Welcome to the official site of Z Home Loans. We are a full-service mortgage company based in Santa Monica, California. We specialize in all types of residential home loans in Southern and Nothern California. Z Home Loans takes great pride in being one of the premiere Mortgage Companies serving Los Angeles' Westside and surrounding environs. Many of our Mortgage Professionals have over a quarter of century experience in Mortgage Lending Industry. Highest and Best Service is not just our motto, it is our mandate to you, our client. Nothing is more important to us than knowing we have provided you with the best Associates, best team, best recourses, and best local knowledge thaht can only come fromyear of experience in Mortgage Lending. Whether you are buying a home or refinancing in any of the California zip codes we can help you realize your dream of homeownership or save you money when getting your new lower monthly payment.

In terms of Purchase Loan programs, we offer the following:

Refinancing? We can help you with that, too!

We offer a wide range of refinancing options, designed to best meet the needs of local borrowers. If you're looking for cash out, or to just get a better rate and term, we can assist you. We offer the following Refinancing Programs:

Contact APT Mortgage Inc dba Z Home Loans today to discuss your mortgage loan options, and find out which loan program will best suit your needs.

Licensed by the DRE #01881581 and NMLS # 362509